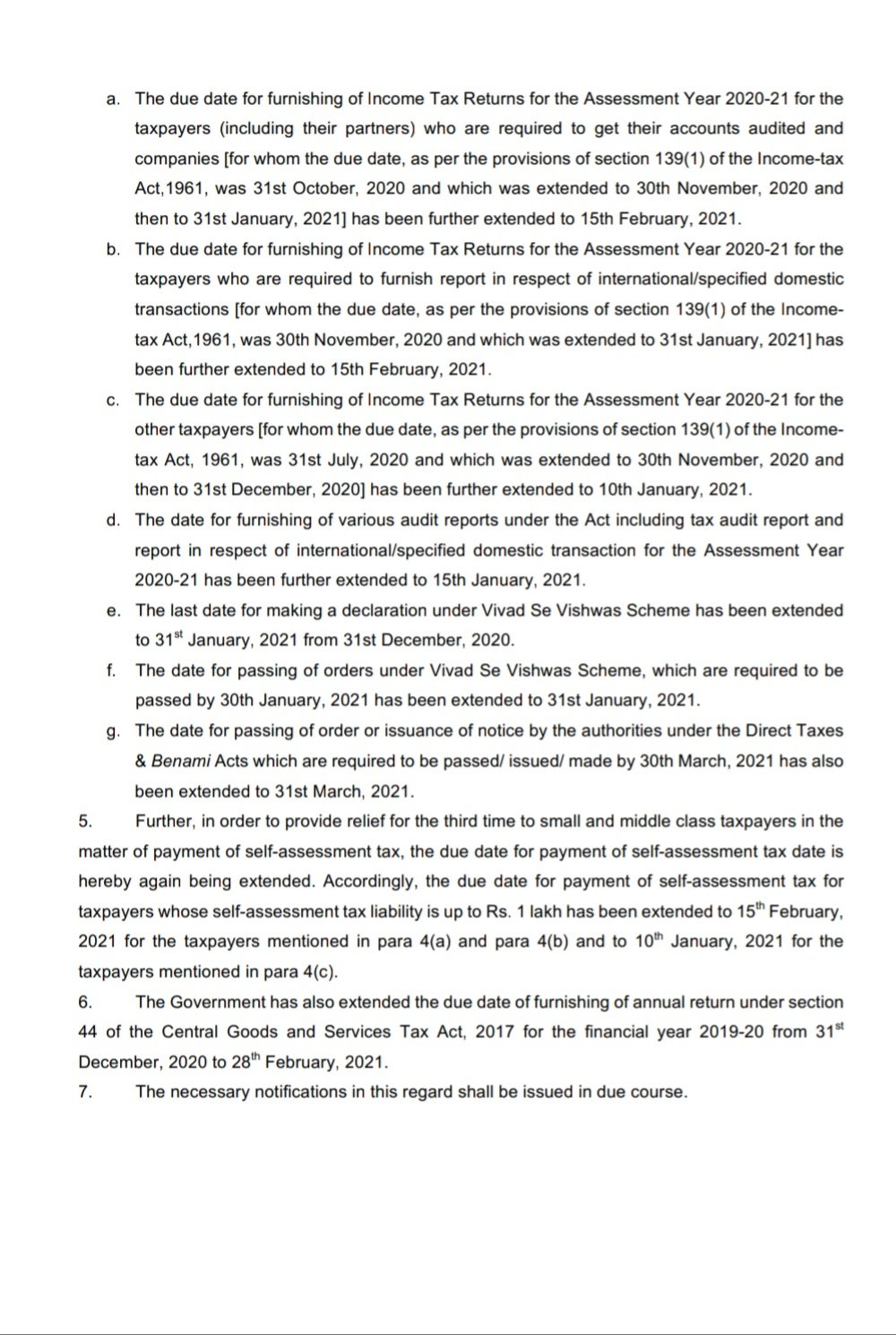

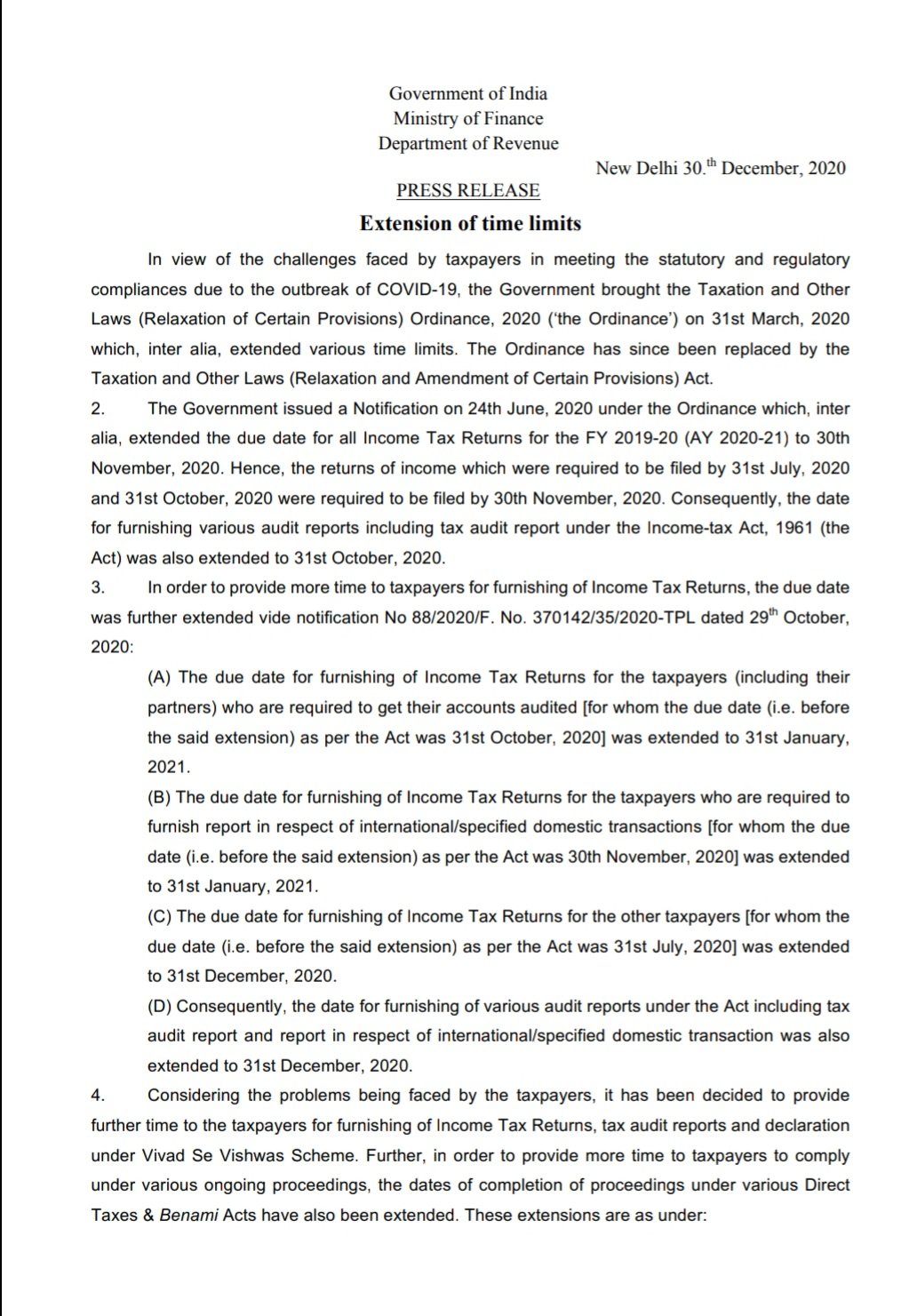

The government has extended the deadline to file income tax return (ITR) for FY 2019-20 for individuals from the current deadline of December 31, 2020, to January 10, 2021. The extension of the deadline is for those individuals whose accounts are not required to be audited and who usually file their income tax return using ITR-1 or ITR-4 forms, as applicable, as per the press release dated December 30, 2020.

This is the third time that the government has extended the deadline to file IT ..

Further, this year, if the ITR was not filed by the earlier deadline December 31, then the penalty or late filing fees levied for filing a belated ITR would have been twice that payable the previous year. This is because if you miss the normal ITR filing deadline (i.e. July 31) and file a belated return by December 31 of the same year, then a late filing fee of Rs 5000 is payable. However, if belated ITR is filed between January 1, and March 31 of the relevant assessment year then the late filing ..

It is to be noted that late filing fees or penalty is only Rs 1,000 for those with taxable income up to Rs 5 lakh and those required to file returns under the seventh proviso of Section 139(1) of the Income-tax Act. This is a recently introduced proviso which makes it mandatory for people to file ITRs if they meet certain specified criteria even if they are not mandatorily required to do so under the normal/regular provisions of the IT Act.

Under this newly introduced proviso, ITR filin ..